SMM January 21 News:

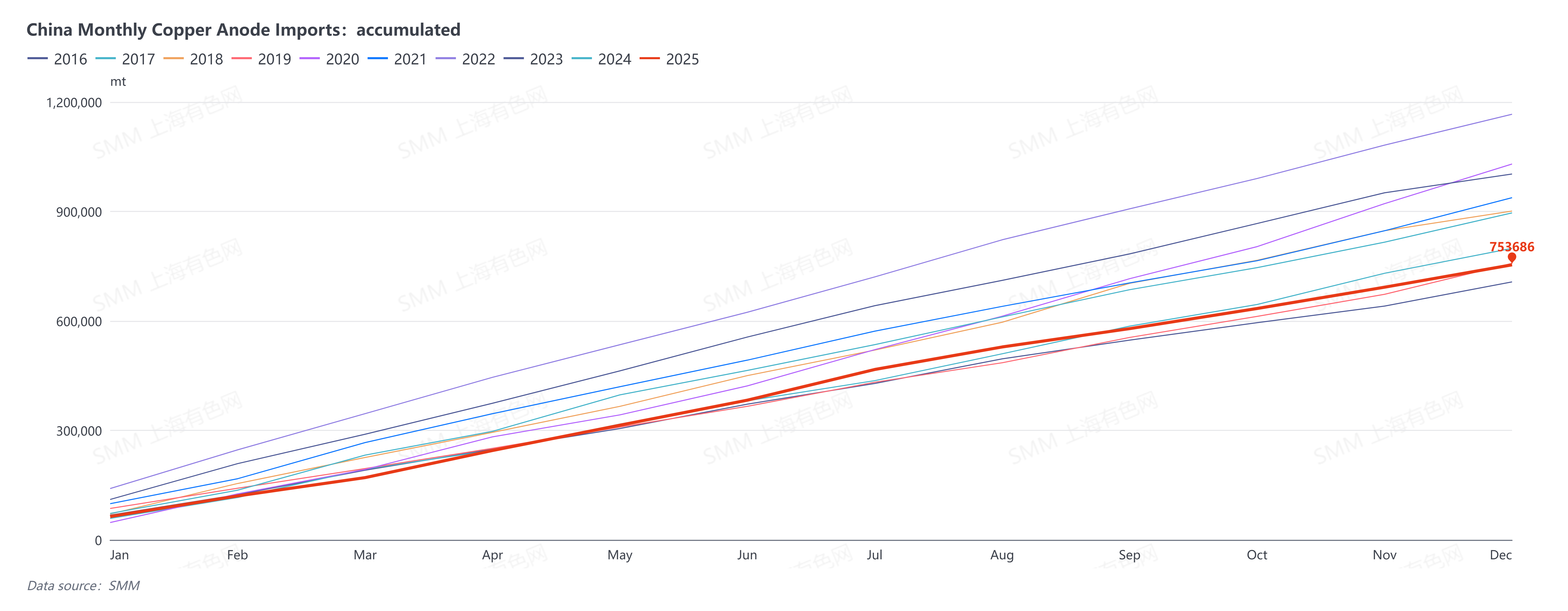

According to data from the General Administration of Customs, China imported 61,300 mt of copper anodes (HS code: 74020000) in December 2025, up 5.15% MoM but down 23.52% YoY. Total imports for January-December 2025 reached 753,700 mt, down 15.88% YoY.

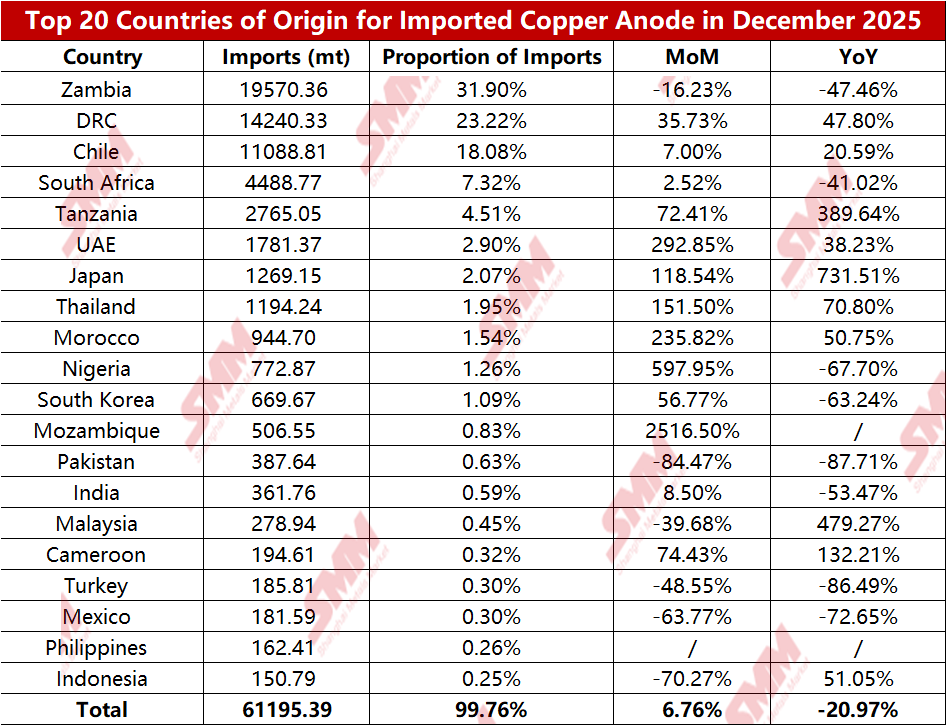

By country, China imported 19,600 mt of copper anodes from Zambia in December 2025, accounting for 31.90% of total imports, down 16.23% MoM and 47.46% YoY. Imports from the DRC were 14,200 mt, accounting for 23.22%, up 35.73% MoM and 47.80% YoY. Imports from Chile were 11,100 mt, accounting for 18.08%, up 7.00% MoM and 20.59% YoY.

China's full-year copper anode imports in 2025 fell significantly YoY, hitting a 9-year low since 2017. However, this performance seems inconsistent with both the increase in China's copper refining capacity and the deterioration of copper concentrate TCs in 2025. SMM analysis attributes the significant decline in 2025 imports mainly to the following reasons:

1. Decline in overseas supply. Overseas copper anode producers saw almost no capacity growth in 2025, and some experienced production declines amid tight copper concentrate supply. Additionally, import arbitrage remained unfavorable for extended periods, coupled with logistics constraints in Africa and overseas political factors.

2. Expansion of overseas demand. Growth in overseas refining capacity outpaced smelting capacity, diverting some material to other regions (such as India).

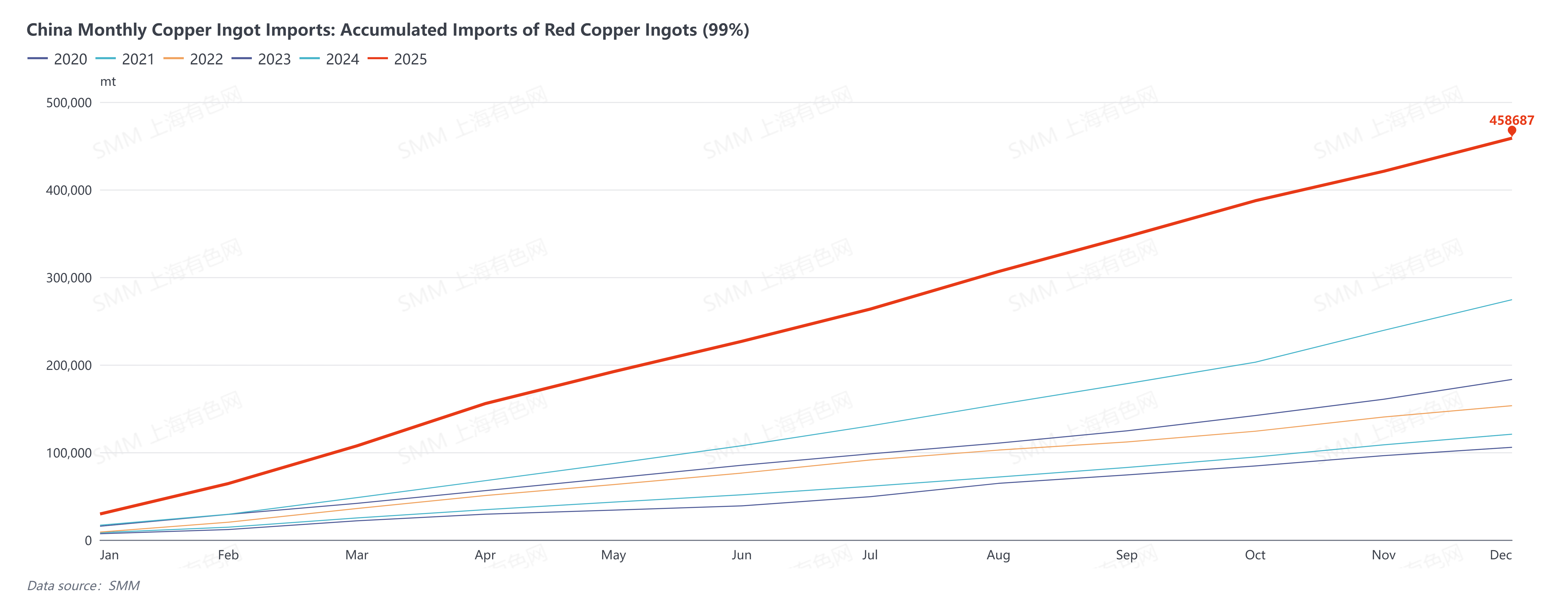

3. Shift in raw material structure for Chinese copper smelters. Due to rising copper prices in 2025, the wide price spread between primary metal and scrap encouraged continuous flow of secondary copper into smelting. Copper scrap, scrap-derived blister copper, and scrap-derived copper anodes became key supplements for Chinese smelters. Meanwhile, imports of scrap copper ingots increased significantly in 2025. In December 2025, China imported 37,800 mt of scrap copper ingots (red/purple copper ingots) (HS code: 74031900), up 13% MoM and 8% YoY. Cumulative imports for January-December 2025 reached 458,700 mt, up 67% YoY. The top three source countries for January-December were Zambia (93,300 mt), the DRC (70,600 mt), and Pakistan (67,700 mt).

The Kamoa copper smelter (annual blister copper capacity of 500,000 mt) in the DRC commenced operations at the end of 2025 and is expected to boost copper anode imports after Q2 2026. However, from a broader copper element perspective, short-term tightness in copper concentrates will impact global blister copper production. As a result, the 2026 blister copper RC Benchmark CIF China was finalised at $85/mt, down $10/mt from $95/mt in 2025. This indicates that even with new overseas copper anode capacity next year, tight copper ore supply is raising market expectations for global copper anode demand in 2026.